Caps are flying, cameras are flashing—and just like that, your student is stepping into a whole new world. Whether they’re packing for a dorm or prepping for their first full-time job, graduation isn’t just a celebration; it’s a launchpad. This is the perfect time to start real-world money conversations.

Here are some key financial topics to explore based on where your grad is headed.

For High School Grads: Getting College-Ready

- Budgeting & Everyday Expenses

College introduces a new level of financial responsibility. From textbooks and groceries to gas and laundry, help your student create a simple budget so they can track spending and prioritize essentials. Budgeting apps like EveryDollar can be great! - Paying for School

Go over how college will be funded—savings, scholarships, financial aid, or student loans. Make sure they understand loan basics: interest, repayment, and what it means to borrow. A little clarity now goes a long way later. - Build Credit Carefully

If appropriate, consider adding them as an authorized user on a credit card to begin building credit responsibly. Talk about how credit works, why paying off balances matters, and why it should never be used to buy something they can’t already afford. - Introduce Financial Basics

Teach them how to manage a checking account, avoid overdrafts, use a debit card, and even file a basic tax return. Encourage smart habits—like only spending what’s in their bank account and setting aside a bit for savings. - Start with Support

You don’t need to hand over total control right away. Offer guidance as they make small financial decisions. It’s about helping them dip their toes in—so they’re more confident when it’s time to dive in.

For College Grads: Taking the Next Step

- Secure a Job—and a Plan

Encourage your graduate to focus on securing steady work—even if it’s not their dream job yet. Everyone starts somewhere, and getting a foot in the door matters more than perfection. - Plan for Retirement & Emergencies

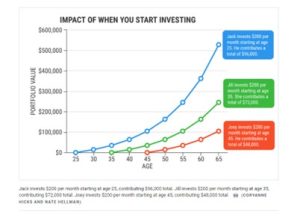

If their employer offers a 401(k), especially with matching, encourage your grad to enroll right away. Even small contributions in their twenties can turn into significant savings over time. This article from U.S. News offers helpful charts that show just how powerful early investing can be. At the same time, starting an emergency fund with even $500–$1,000 can provide peace of mind and prevent unnecessary debt.

- Avoid Credit Card Pitfalls

Credit card debt is easy to rack up and hard to shake. Talk about using credit wisely, avoiding interest, and paying off balances in full to avoid long-term financial stress. - Set Short- and Long-Term Goals

Whether it’s paying off student loans, buying a car, or saving for a home, help them outline goals and create a plan. Ask where they want to be at 25—or 35—and how today’s choices shape that vision.

From budgeting to retirement planning, Anchor Wealth Management is here to support your graduate’s next chapter with trusted guidance and tools to stay on track

By Chris Perry, Wealth Advisor