May 2025 Blog Newsletter

Captain’s Log

Simplify Your Financial Life with One Trusted Advisor

In today’s complex financial landscape, investors often seek professional guidance to manage their portfolios and plan for the future. While some may consider hiring multiple advisors—believing it provides diversification or additional insight—the reality is that working with a single trusted financial advisor can offer far greater clarity, efficiency, and long-term benefits.

A Comprehensive, Top-Down View

A single advisor can view your entire financial picture—from investments and retirement planning to taxes, college funding, and estate considerations. This “top-down” perspective is essential for making well-integrated decisions. Working with one advisor mitigates the chance that something is siloed or overlooked. In contrast, multiple advisors often work in isolation, each only seeing a portion of your financial life, leading to fragmented or even conflicting advice.

Lower Costs and Simplified Reporting

Most advisory firms offer tiered fee structures, meaning clients with more assets under management often benefit from lower overall costs. Splitting your accounts among multiple advisors can reduce your pricing power and increase cumulative expenses. Consolidatedaccount management can also mean fewer statements, simpler reporting, and less taxpaperwork—an efficiency that shouldn’t be understated. Just as you likely wouldn’t use two tax accountants, working with two financial advisors can usually add unnecessary complexity.

Duplication and Strategy Conflict

While having multiple advisors may seem like a way to diversify, it often results in unintentional overlap. You might unknowingly hold the same stock or fund in severalaccounts, negating the very diversification you’re trying to achieve—while also increasing taxcomplexity and transaction costs. On the other hand, if each advisor follows a different investment philosophy, you’re no longer adhering to either plan. Instead, you’re creating a patchwork strategy that may lack coherence and alignment with your long-term objectives.

Clearer, More Effective Advice

Effective financial guidance requires full visibility. If each advisor only sees a portion of your assets, none can provide fully informed advice. This can impact everything from asset allocation to retirement withdrawals and tax efficiency. When you consolidate under oneadvisor, they can deliver comprehensive, personalized advice that fits your complete financialpicture—including advanced strategies such as ACA subsidy planning, IRMAA thresholds, andcapital gain harvesting.

Risk Management and Relationship Depth

Multiple advisors can unintentionally increase your overall risk. Each may feel pressure to outperform the other, leading to overly aggressive decisions that jeopardize your financial security. A single advisor, on the other hand, can manage risk appropriately across your entire portfolio. Plus, a long-term relationship with one advisor can foster deeper trust and continuity—qualities that are especially valuable during major life transitions.

Estate Planning and Simplification

Consolidation is also critical from an estate planning perspective. Many families can face significant challenges when a loved one passes away and leaves behind scattered accounts across multiple institutions. With one advisor managing your assets through a centralized custodian, your accounts are easier to administer and more secure. Assets held by custodians are segregated from the firm’s assets and are protected in the event of a firm failure.

Conclusion

In financial planning, clarity and coordination are essential. Partnering with a single financial advisor can lead to better strategic alignment, lower costs, and improved long-term outcomes. It can simplify your financial life, enhance the quality of advice, and build a stronger, more consistent relationship. When it comes to building and protecting wealth, one clear voice is often more powerful than many competing ones.

Guest Author – Dan Leonard, CFA, Lead Planning and Trade Associate

Operation Christmas Child

How Can You Help?

We will be collecting donations from now to October 13th. You can help by purchasing an item(s) from our Amazon wishlist.

Please have your donation sent to our Rockfordoffice, and we will hold it until our Packing Partyin October (more details to come).

Please join us in making this holiday season a little brighter for children in need.

Thank you in advance for your generosity and support! If you have questions, contact Chris DeSchepper at (815) 201-5011 Ext. 1020.

Refer A Friend

Our goal is to help as many people as possible find the financial freedom they seek.

If you know a friend or family member who could benefit from Anchor Wealth Management’s services, please visit our website and complete the Refer A Friend

form.

We will reach out to offer our services and a Complimentary financial planning consultation.

You can also email Chris DeSchepper at chrisd@anchorwm with their contact information.

Financial Conversations to Have With Your High School or College Grad

Caps are flying, cameras are flashing—and just like that, your student is stepping into a whole new world. Whether they’re packing for a dorm or prepping for their first full-time job, graduation isn’t just a celebration; it’s a launchpad. This is the perfect time to start real-world money conversations.

Here are some key financial topics to explore based on where your grad is headed.

For High School Grads: Getting College-Ready

- Budgeting & Everyday Expenses

College introduces a new level of financial responsibility. From textbooks and groceries to gas and laundry, help your student create a simple budget so they can track spending and prioritize essentials. Budgeting apps like EveryDollar can be great! - Paying for School

Go over how college will be funded—savings, scholarships, financial aid, or student loans. Make sure they understand loan basics: interest, repayment, and what it means to borrow. A little clarity now goes a long way later. - Build Credit Carefully

If appropriate, consider adding them as an authorized user on a credit card to begin building credit responsibly. Talk about how credit works, why paying off balances matters, and why it should never be used to buy something they can’t already afford. - Introduce Financial Basics

Teach them how to manage a checking account, avoid overdrafts, use a debit card, and even file a basic tax return. Encourage smart habits—like only spending what’s in their bank account and setting aside a bit for savings. - Start with Support

You don’t need to hand over total control right away. Offer guidance as they make small financial decisions. It’s about helping them dip their toes in—so they’re more confident when it’s time to dive in.

For College Grads: Taking the Next Step

- Secure a Job—and a Plan

Encourage your graduate to focus on securing steady work—even if it’s not their dream job yet. Everyone starts somewhere, and getting a foot in the door matters more than perfection. - Plan for Retirement & Emergencies

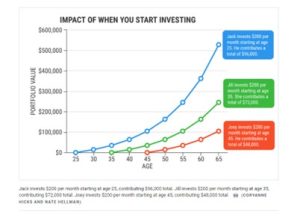

If their employer offers a 401(k), especially with matching, encourage your grad to enroll right away. Even small contributions in their twenties can turn into significant savings over time. This article from U.S. News offers helpful charts that show just how powerful early investing can be. At the same time, starting an emergency fund with even $500–$1,000 can provide peace of mind and prevent unnecessary debt.

- Avoid Credit Card Pitfalls

Credit card debt is easy to rack up and hard to shake. Talk about using credit wisely, avoiding interest, and paying off balances in full to avoid long-term financial stress. - Set Short- and Long-Term Goals

Whether it’s paying off student loans, buying a car, or saving for a home, help them outline goals and create a plan. Ask where they want to be at 25—or 35—and how today’s choices shape that vision.

From budgeting to retirement planning, Anchor Wealth Management is here to support your graduate’s next chapter with trusted guidance and tools to stay on track

By Chris Perry, Wealth Advisor

Adam’s Nightstand

I’ve started reading Culture by Design: 8 Simple Steps to Drive Better Individual and Organizational Performance by David Friedman.

One key takeaway early in the book is that your culture is your identity, and that identity is how your business sets itself apart in the world. In a commoditized marketplace, culture becomes one of the few remaining ways to differentiate. It impacts your ability to attract and retain top talent, influences employee productivity, and shapes every interaction with your customers.

Friedman emphasizes that every organization has a culture, whether intentional or not. You can feel it the moment you walk through the door—or even when you call. Are people friendly? Is the environment clean and organized? How do employees relate to each other? These everyday behaviors form the backbone of your company’s culture.

What I really appreciate about this book is that it takes a concept often considered vague or “soft” culture and breaks it into simple, actionable steps any organization can implement. Would you like to read this book? You can find it on Amazon.