January 2024 Blog Newsletter

January Captain’s Log

Building A Purposeful Financial Journey With Clients

Happy New Year!

Anchor Wealth Management had an incredible 2023, exceeding expectations and building meaningful connections with clients. My vision for 2024 is inspiring—helping clients better understand the purpose of their money and aligning it with their unique goals and aspirations.

The approach of asking the right questions to uncover what truly matters to each client is powerful. Money indeed serves as a tool to enable various dreams—from supporting future generations’ education to fostering experiences with loved ones and contributing to causes close to their hearts. The variety of goals among our clients reflects the beauty of individual dreams and aspirations.

Asking thought-provoking questions like imagining unlimited financial resources can open up new perspectives and deeper insights into what our clients truly value. It is through these conversations that clients can gain clarity, find peace of mind, and live with intention, free from past financial regrets.

Our commitment is to continually improve the questions we ask, which demonstrates a dedication to nurturing these meaningful dialogues. It is these conversations that will guide our clients toward financial independence while allowing them to live purposefully.

Anchor Wealth’s emphasis on understanding the purpose behind our clients wealth and utilizing it to fulfill these varied dreams truly exceeds the standard set by our industry. Here is to a year filled with enriching conversations, fulfilled goals, and continued success in empowering clients to live their best lives.

How To Crush A No Spend Month

For many people, January ’tis the season for paying off holiday bills. In a world that constantly bombards us with advertisements and temptations to spend, the idea of a “No Spend Month” may seem challenging or even daunting. However, this financial challenge is not about depriving yourself of necessities; it’s about making conscious choices to abstain from non-essential spending and build good spending habits to carry you through the rest of the year.

Why a No Spend Month?

A “No Spend Month” is not just about saving money; it’s a valuable exercise in understanding the difference between needs and wants. By intentionally choosing not to spend on non-essential items, you can redirect your focus towards your financial goals, whether it’s building an emergency fund, paying off debts, or investing in the future.

Accountability Matters

To successfully navigate a “No Spend Month,” accountability plays a crucial role. Share your commitment with a friend, family member, or even your financial advisor. Creating a visual representation, such as a calendar, can help you track your progress and stay motivated. Knowing that someone is aware of your goal can provide the necessary support and encouragement to resist impulsive spending.

Avoid High Spending Areas and use a Budget Calculator

One effective strategy is to stay away from environments that trigger excessive spending. Ignore online ads, log yourself out of your Amazon account, unsubscribe from tempting newsletters, and steer clear of shopping malls. Employ an online budget calculator to assist you in sticking to the financial goals you set at the beginning of your No Spend Month. To help you stick to your budget goals, Anchor Wealth Management recommends using EveryDollar’s online tool: http://tinyurl.com/6br9kdtm.

Focus on What’s Important

During a No Spend Month, it’s essential to shift your focus from what you want to what you already have. Be grateful for the possessions, experiences, and opportunities that surround you. Explore free local entertainment, rediscover hobbies and games already at home, and appreciate the abundance already present in your life. Recognizing that buying the next material possession doesn’t bring lasting happiness is a key step towards financial contentment.

Can It Wait?

After your successful “No Spend Month,” continue to monitor your spending. Practice self-honesty and question your motivations before making a purchase. Ask yourself, “Can it wait?” If the answer is yes, it’s likely a want rather than a need. This simple question can help you differentiate between impulsive desires and genuine necessities, preventing unnecessary spending.

Closely watching your finances is not just a financial challenge; it’s a journey towards financial empowerment and mindfulness. It’s okay to start small and take a week or two to challenge yourself during your first “No Spend Month.” By taking control of your finances and spending habits now, you are laying the foundation for a more financially secure and fulfilling future.

Print Dave Ramsey’s No Spend Calendar and check off every day you make it through.

By Rianna Caswell, Wealth Advisor

Learn More about Rianna and the AWM Team

Adam’s Nightstand

I read “Win the Day” by Mark Batterson. 7 Daily Habits to Help You Stress Less & Accomplish More. The book really reminded me of Stephen Covey’s The 7 Habits of Highly Effective People.

Mark Batterson tied in the success of The 7 Habits of Highly Effective People into a Christian and Biblical viewpoint through the book 7 Habits to Help You Stress Less & Accomplish More.

Mark has accomplished so many wonderful things with his ministry centered in Washington, D.C and throughout the world.

I love the concept of playing it safe is risky, resetting and reaching for bigger goals, and continual improvement.

I cannot wait to apply what I have learned from Mark’s 7 habits: flip the script, kiss the wave, eat the frog, fly the kite, cut the rope, wind the clock, and seed the clouds.

Quit wasting guilt on yesterday. Quit wasting worry on tomorrow. It is time to start living for TODAY!

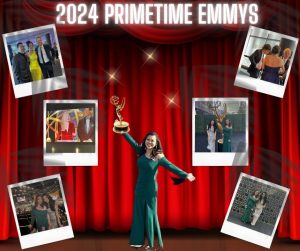

Glamour And Glitz At The 2024 Emmy’s

AWM Team Member Cherry Johnson attended the 2024 Primetime Emmy’s held on January 15th at the Peacock Theater in Los Angeles, CA as a special guest of her sister, Phuong Kubacki.

Phuong is an actress, who has appeared in Better Call Saul, Chicago PD, and Blue Bloods. Phuong’s next project The Bike Riders starring Austin Butler and Tom Hardy arrives in theaters on June 21st. Phuong also appears in General Hospital on January 31st.

This is the second consecutive year that Cherry and Phuong have glammed up and walked the red carpet.

Cherry snapped a few photos of celebrities at the event. In the upper left corner is Phil Keoghan, host and nominee for the Amazing Race.

She got a photo of actor Jessie Eisenberg before the show began.

Cherry loves all things food and fine dining. Although it was a quick trip, Cherry and Phuong had a nice dinner at Joey DTLA.